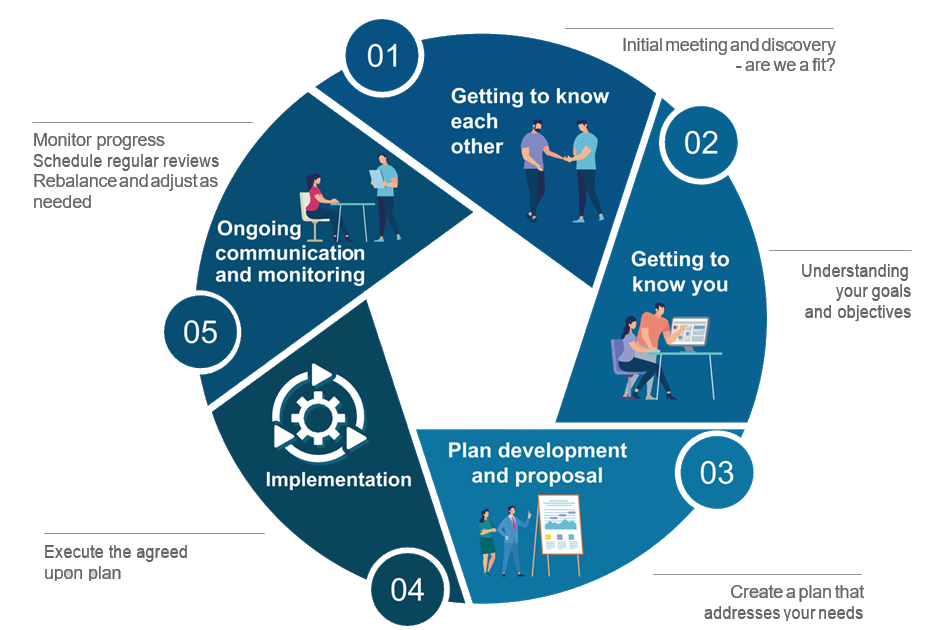

Client Engagement Process

Click on each step to learn more!

1. Getting to know each other, initial meeting

We need to understand you and what's important to you.

You will also want to get to know us and ask questions.

This is potentially the start of a long-term relationship; therefore, we need to start it right.

2. Getting to know you, the details

We will ask questions designed for us to gain a deeper understanding of you.

We need to know what's important to you, your various goals and objectives, your assets, liabilities, risk exposures, and opportunities.

3. Plan development and proposal

We will develop a plan that is aligned with your goals, and addresses your needs.

We will clearly explain and present it to you.

We will move towards implementation only once you are comfortable and ready.

4. Implementation

We will execute the plan and strategies as agreed upon.

5. Ongoing communication and monitoring

We will maintain regular communication, monitor your portfolio, and meet you for reviews.

Here are some of the reasons, among others, you can expect to hear from us:

- Provide educational and relevant information

- Share market and investment updates

- Propose recommendations to re-balance your portfolio

- Schedule annual portfolio reviews

Throughout the year, we are regularly reviewing and monitoring our client portfolios and investment strategies.

We also use various sources of research to maintain a forward-looking view which determines how we build our portfolios.

Additionally, our clients benefit from our experience as it relates to various planning and tax-driven strategies.