GICs

GICs are a safe and reliable investment that offer a guaranteed return.

If you’re not satisfied with the low rates of return from savings and chequing accounts, or the higher risk associated with mutual funds, a Guaranteed Investment Certificate (GIC) can be a reliable option to grow your savings.

Guaranteed means guaranteed

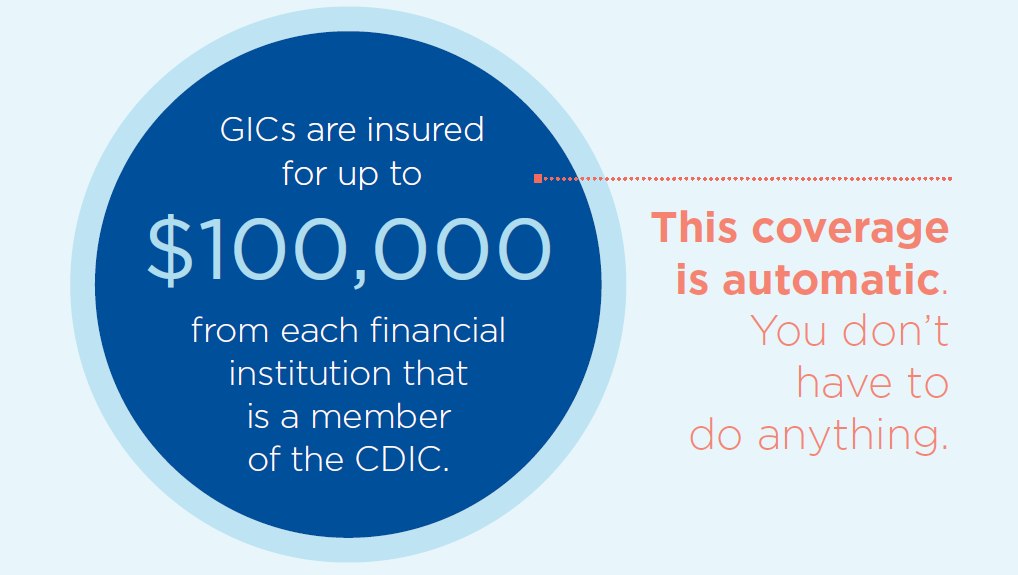

The principal and interest on a GIC are guaranteed by the bank or financial institution issuing it and by the Canadian Deposit Insurance Company up to $100,000.

The Canadian Deposit Insurance Company (CDIC) is a federal Crown corporation that insures eligible deposits to banks and other financial institutions.

CDIC insures deposits in Guaranteed Investment Certificates (GICs) and other deposits (up to $100,000 in savings held in one name, plus up to $100,000 in savings held in a joint account) with an original date to maturity of 5 years or less held in Canadian dollars at a CDIC member.

Rate of return

Unlike a mutual fund or stock, you know that a GIC’s fixed or variable interest rate will provide you with a guaranteed return.

However, because GIC rates are often low, you’ll need to earn at least the rate of inflation or risk seeing the buying power of those funds decrease over time.

For instance, if your money earns 2% interest in a GIC, but the rate of inflation is 3%, the purchasing power of those funds will actually go down.

Fees and expenses

When you buy a GIC, the interest you earn doesn’t have any fees or charges deducted, unlike other investments such as mutual funds.

Liquidity

Non-redeemable GICs which typically have a higher rate of return often require that you lock in your savings for an agreed upon length of time before they reach maturity – at which time you can access them again.

For other types of GICs, fees and penalties may apply if you need to access your funds early.

Did you know?

FAQ5

Five questions and answers about GICs

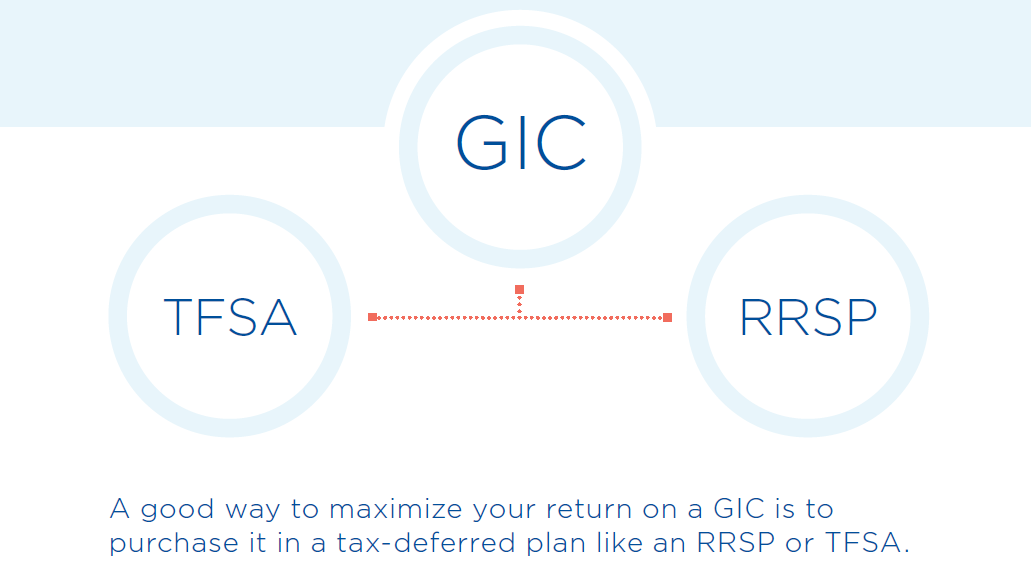

Yes. In fact, you can buy a variety of GICs inside your RRSP, TFSA or RESP accounts.

These include non-redeemable GICs that generally yield a higher return, cashable GICs that can be cashed after 30 days without penalty, market-linked GICs that offer the potential for returns linked to the stock market while keeping your principal protected, as well as a host of other GIC options.