Registered Retirement Income Fund

As you approach retirement, it’s a good idea to start thinking about your options for converting your Registered Retirement Savings Plan (RRSP) into retirement income.

Government regulations require you to select an option by the end of the year in which you turn 71 and begin withdrawing funds the following year.

By far the most popular choice among Canadian retirees is the Registered Retirement Income Fund (RRIF).

RRIF's explained

A RRIF is a registered investment account that’s used to provide for income rather than savings. In other words, you don’t make contributions to your RRIF; instead, you take the money that you’ve saved in your RRSP and put it into your RRIF to fund your retirement.

As with an RRSP, earnings on the investments inside your RRIF are tax-sheltered until they are withdrawn. By converting your RRSP to a RRIF, you avoid cashing in your RRSP for a lump-sum payment, which would likely result in a significant tax hit.

A RRIF can generally hold the same types of investments as an RRSP.

Making Withdrawals

Depending on your income needs, you can set up your RRIF and start collecting retirement income before you turn 71. Each year, you will have to withdraw a minimum amount, which varies depending on your age.

Before you turn 71

Use the following three-step calculation to determine minimum withdrawals prior to age 71:

1. Subtract your age from 90.

2. Get the market value of your RRIF, either from your investment statements or by contacting your financial advisor or financial institution.

3. Divide the market value by the result of step 1.

For example, if you were 67 on January 1, and your RRIF was worth $100,000:

1. 90 – 67 = 23

2. Market value: $100,000

3. Minimum withdrawal: $100,000 ÷ 23 = $4,348

After you turn 71

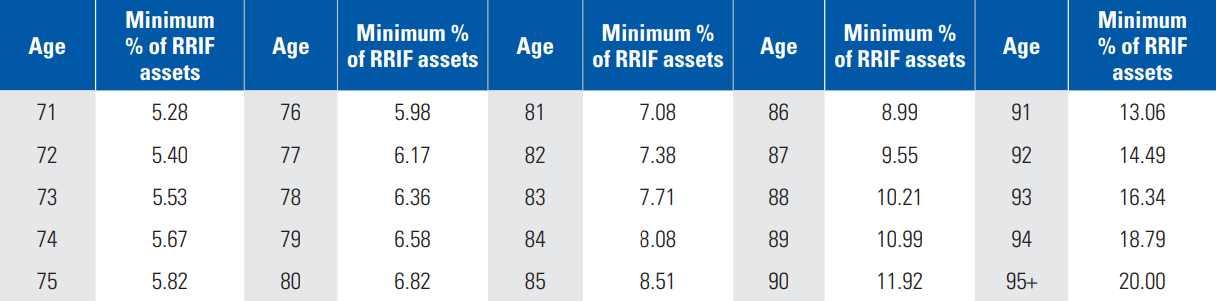

If you’re making withdrawals after you turn 71, your minimum withdrawal amounts are set by the government. The table below shows the government-mandated RRIF withdrawal minimums.

For example, if you’re 75 with $100,000 in your RRIF, your minimum withdrawal is $100,000 x 5.82% or $5,820. Normally, the minimum withdrawal amount is based on your age. However, if you have a spouse who is younger than you, you may use your spouse’s age to determine the minimum withdrawal amount. Importantly, you must make this decision before you make your first withdrawal, and you can’t change your mind later on.

Your retirement income

The amounts given here are minimum withdrawal amounts. You can choose to withdraw more, depending on your income needs. When deciding how much to withdraw, think about all your sources of retirement income. These may include: