Extra Extra! Read all about it…

…or not? We are inundated daily, hourly, or perhaps more accurately “during real-time”, with news of events and happenings around the world. The distribution and consumption of news is literally one click or a swipe away and available in the palm of our hand. How does this impact us? Our lives? Our relationships? Big questions I will not seek to answer, however with one exception, in respect to investing I suggest it is not good for our financial health and perhaps we should not read all about it. In fact, as emotional beings, we put ourselves in a position to potentially make harmful decisions – simply put we tempt ourselves to sell low and buy high. The more we focus on the news, we increase the pressure.

Investors love to read headlines and we seem to feed off the drama of a day’s events. “Newsmakers” have a goal – to keep consumers coming back for more. Their duty is not to produce or encourage informed investing or investors. In the short term, capital markets are driven by fear and greed. This is actually a good thing and exploited by those who are in a position to make truly informed unemotional decisions. In the long term, markets are driven by cash flow, earnings and the ability of companies to grow these over time. This is also a good thing as it rewards intelligent, patient and truly informed investors.

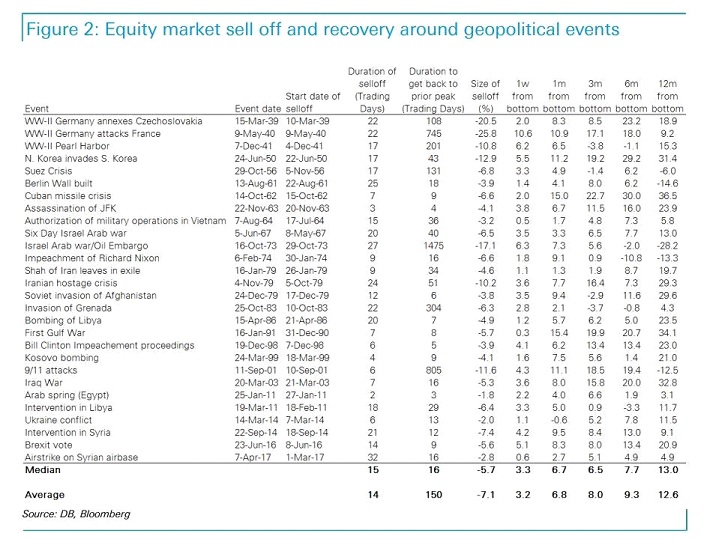

Volatility often follows announcements of scandal, military mobilization, natural disasters etc. Consider the next chart providing context to these events and the resultant effect on markets:

We believe in sensible and sustainable investing. We make unemotional decisions. We view short term volatility as potential opportunity. We like to stay current as well and are aware of the world around us, but history has demonstrated in the examples above, that from a capital markets and investing perspective, we shouldn’t get too caught up in the day’s big event.