Staying the Course is Critical

To date, 2022 has proven a challenging investment environment, but the global economy and markets are capable of coping. After the record-breaking returns of 2021, it’s inevitable the pace of growth will slow in 2022. Over the short term, markets have grappled with many challenges, including war in Eastern Europe, high levels of inflation, and central bank policy shifts. While all these matters are affecting investment results in the short term, over longer periods of time, well managed companies, which are able to consistently grow their earnings and free cash flow, represent attractive investment opportunities. Furthermore, current household savings, consumer demand and wage growth all remain healthy.

Regardless of where we are in the market cycle, it’s important to take a disciplined approach to investing and stay focused on your long-term financial goals. This strategy helps you keep your emotions out of investing, typically buying high and selling low, like many investors do. Ongoing monitoring and reviewing of your portfolio also ensures it remains on track.

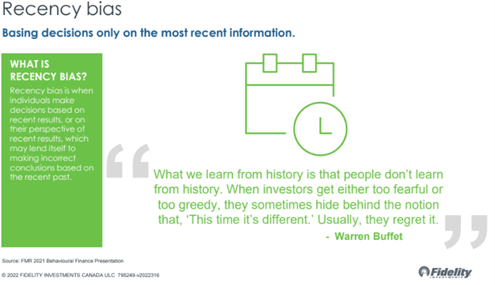

We have a tendency to base decisions only on the most recent information. “Recency bias” is a term used to describe the psychological phenomenon where we give more importance to recent events compared to what happened a while back.

For example, if you are asked to name 30 movies that you have seen there is likely to be a tendency of recalling movies you have seen in the recent 1 or 2 years more than movies you saw 10 – 15 years back.

Recency bias is very common in investing; investors tend to give more importance to short term performance compared to long term performance.

Market volatility can be unsettling; historically, however, the market has recovered from intra-year declines and provided positive returns for investors over time.

Market pullbacks are normal – and happen more than you might think. In calendar years when the market has had very healthy double digit returns – there’s been a point in every year where the markets pulled back and were negative!

- The S&P/TSX Composite Total Return Index has shown a positive return in 29 out of the 36 full years shown on this chart, which is nearly 81% of the time.

Remaining invested is the best solution for investors with a long-term time horizon.

A friendly reminder that recent events have brought us here before, which influenced the creation of the below articles posted to our website blog in the past:

https://sensiblewealth.ca/russian-roulette-ukraine/

https://sensiblewealth.ca/navigating-through-election-uncertainty/

https://sensiblewealth.ca/value-staying-invested/

As investors, we’re not strangers to market pullback and negative markets. It is simply par for the course.

At one point or another, we experience market negativity – often times for different reasons, but the approach is always the same – stay invested.

We are here to support you in achieving your financial goals. Please do not hesitate to contact us.

This information has been prepared by Adrian Van Hooydonk who is a Senior Investment Advisor for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Senior Investment Advisor can open accounts only in the provinces in which they are registered.